Charities Classification System

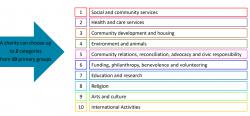

The Charities Regulatory Authority launched a Classification System on 14th November 2022 (as part of Charities Week) which broadly mirrors classification systems in other jurisdictions.

The purpose of the system is to improve functionality of the Charities Register, provide clarity on registered charities, improve data for research.

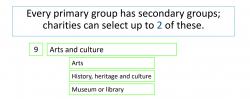

Charities to self-determine classification and rely on a “best fit” as it is not possible to achieve a perfect system. It is important to note that Classification will not put a limit on the types of activities a charity can carry out to further their charitable purpose.

How does it work?

In the example provided by the Charities Regulator, a museum for example would choose category “Arts and Culture” and can then select two secondary groups “History, heritage and culture” and “Museum or library”.

How to search charities using the classification System

A search facility will be introduced when the database is populated. This will be of benefit to funders, researchers and potential volunteers.

What should charities do now?

• Directors to agree on classification and record decision at a Board Meeting.

• Log into MyAccount to complete and submit form

• Once off process (unless charity wishes to amend it in future)

• Automatic registration of classification

• Immediate update to Register of Charities

More Information

There’s a new Classification Section on their website with more information which includes: